Unit of production depreciation calculator

Contribution Margin Calculator. A fixed cost is a cost that does not change with an increase or decrease in the amount of goods or services produced or sold.

Units Of Production Depreciation Definition And How To Calculate Bookstime

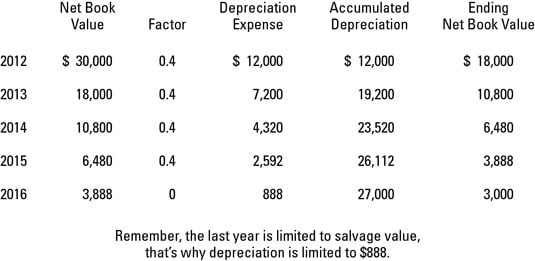

Book value is found by deducting the accumulated depreciation from the cost of the asset.

. Formulas for calculation the planed production cost of the production in Excel. The formula for calculating the planned ratio is the production cost price in monetary terms purchase price. The average cost basisbase value is purchase price minus accumulated depreciation for purchased breeding stock.

Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. Special depreciation allowance or a section 179 deduction claimed on qualified property. Each company calculates the planned production cost in its own way.

Another example where the total fixed cost of production of a company stood at 1500 while the variable cost of production per unit varies with production quantity. 2 Average cost basis is important because it impacts the net income calculation and profitability figures. This calculator uses the predictive equations provided by the Institute of Medicine IOM to compute estimated energy requirements EER.

The transformation process is when object or time is transformed into a product or service. A Direct Cost relates to any production costs service costs or transformation process costs. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20.

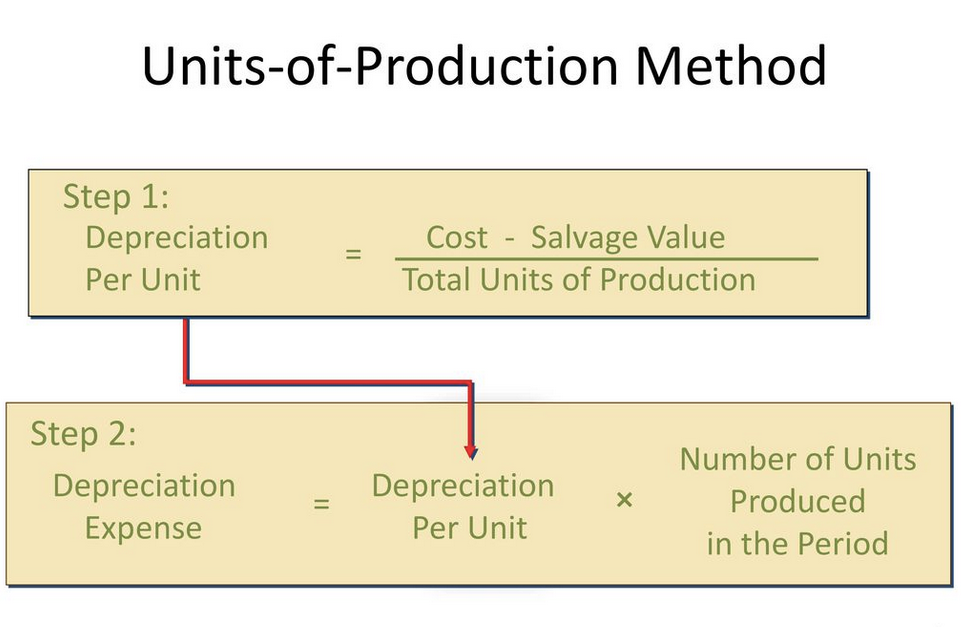

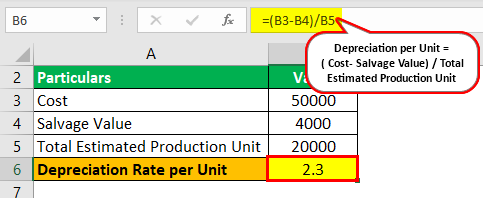

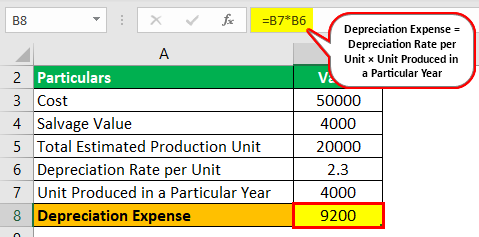

Calculate Property Depreciation With Property Depreciation Calculator. Total Depreciation Per Unit Depreciation Total number of Units Produced. You can use the following Calculator.

For raised breeding stock it is the base value of the animal the cost of raising the animal to that stage eg. Activity such as units produced. Calculate his annual depreciation for the.

Use our Tax Calculator software claim HRA check refund status and generate rent. Calculation through units of production. A few examples of the fixed cost of production are depreciation cost.

Calculate the depreciation per activity and for any period. Activity Method Depreciation Calculator. You can use this Estimated Energy Requirement calculator to determine the number of calories you need to consume to maintain your weight at its current level.

The level of costs for the delivery of goods 1 and 4 will be 10 2 and 3 - 15. So determine the life-time production capacity of the asset in terms of units. Thus it will help you to evaluate your past performance and forecast your future profitability.

Depreciation under Income Tax Act is the decline in the real value of a tangible asset because of consumption wear and tear or obsolescence. We would like to show you a description here but the site wont allow us. Calculate the depreciation per unit produced and for any period based on activity for that period.

Water Intake Calculator new. Depreciation you deducted or could have deducted on your tax returns under the method of depreciation you chose. Mathematically we can apply values in the below.

The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. Ali has a book-printing business and he depreciates his printer on a unit basis. Now let us calculate the average total cost when.

We have to find the straight line depreciation method using the first method. Depreciation Asset Cost Residual Value Useful Life of the Asset. It can be used by both males and females and people of all age groups.

Ali had a total production of 35000 pages this year. It was expected that the current printer has a capacity of 100000 pages when bought 2 years ago at a cost of 10000. Double Declining Balance Method.

Life-time production capacity indicates the total no. Methods of depreciation as per Income Tax Act 1961 Based on Specified Rates. If you didnt deduct enough or deducted too much in any year see Depreciation under Decreases to Basis in Pub.

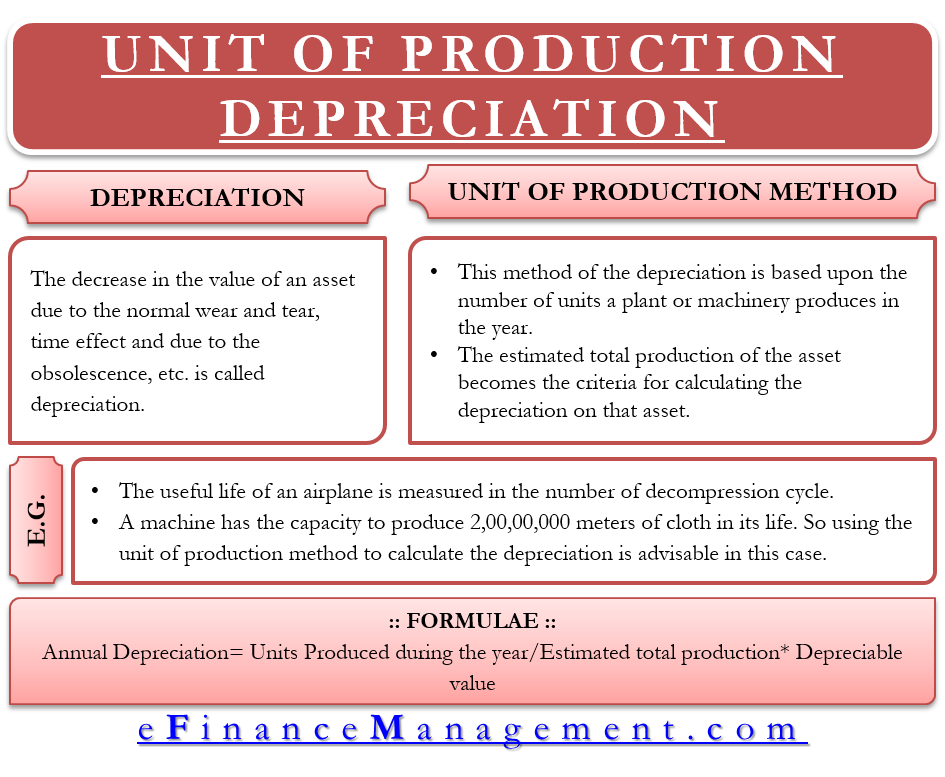

Fixed costs are expenses that have to be paid by a company. Unit of Production Method. Activity such as miles for a car cycles for a machine or time usage.

Car Depreciation Calculator new. Units of Production Depreciation Calculator. You can use the contribution margin calculator using either actual units sold or the projected units to be sold.

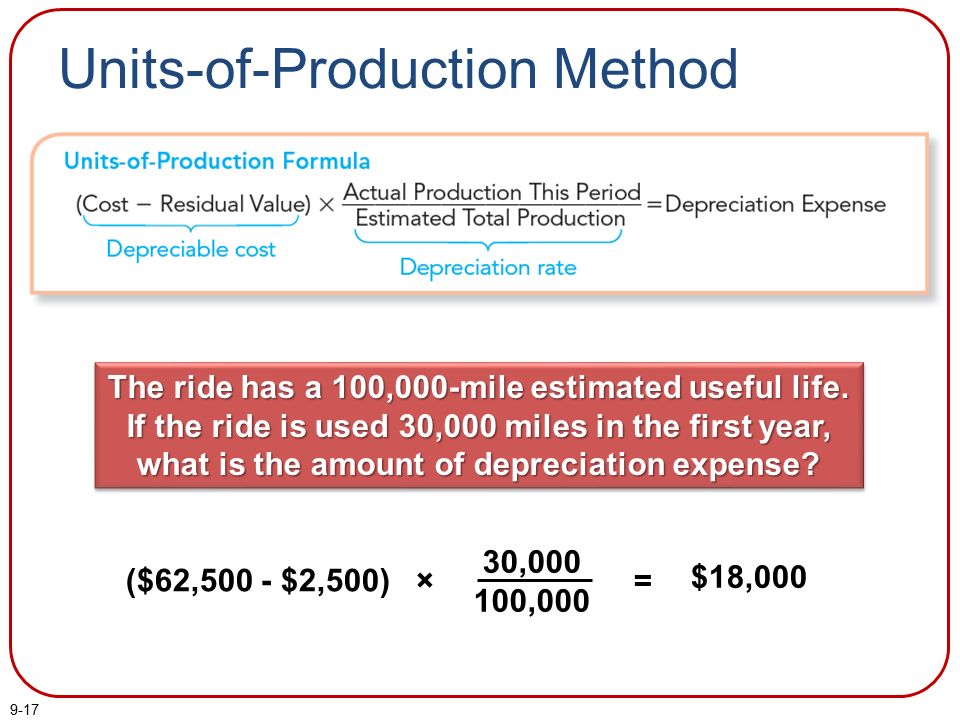

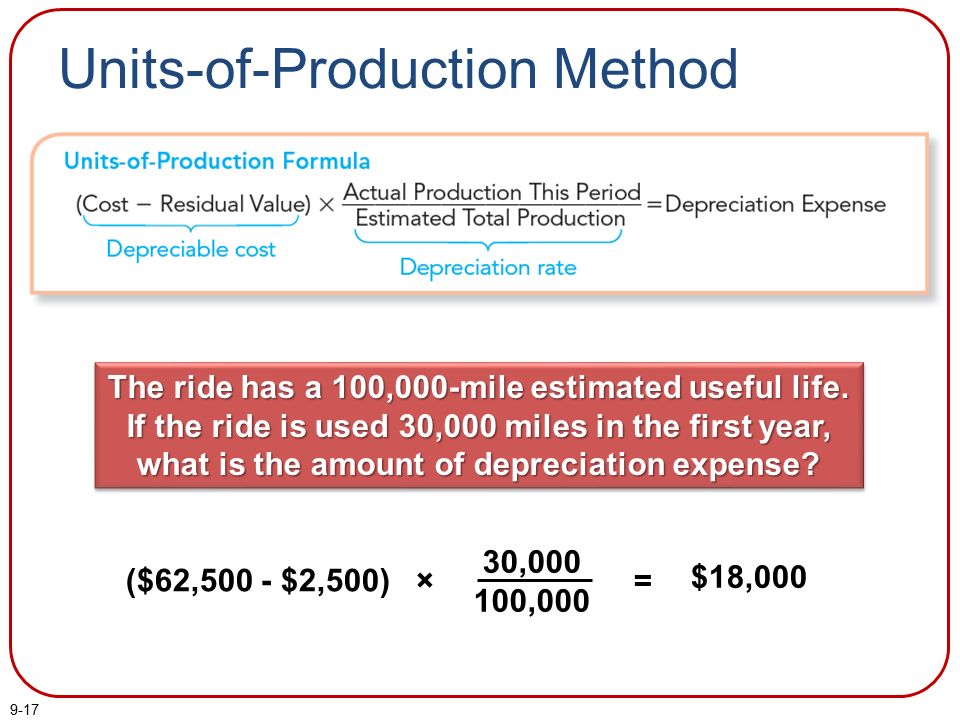

The following additional steps can be used to derive the formula for depreciation under the unit of production method.

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Calculating Depreciation Unit Of Production Method

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Dummies

Depreciation Calculator

Unit Of Production Depreciation Method Formula Examples

Unit Of Production Depreciation Method Formula Examples

Units Of Production Depreciation Calculator Efinancemanagement

Unit Of Production Depreciation Efinancemanagement

How Do I Calculate Depreciation Formula Guides Examaples

Unit Of Production Depreciation Method Formula Examples

How To Calculate Units Of Production Depreciation In Excel

Depreciation Formula Calculate Depreciation Expense

Long Lived Tangible And Intangible Assets Ppt Download

Depreciation Formula Examples With Excel Template